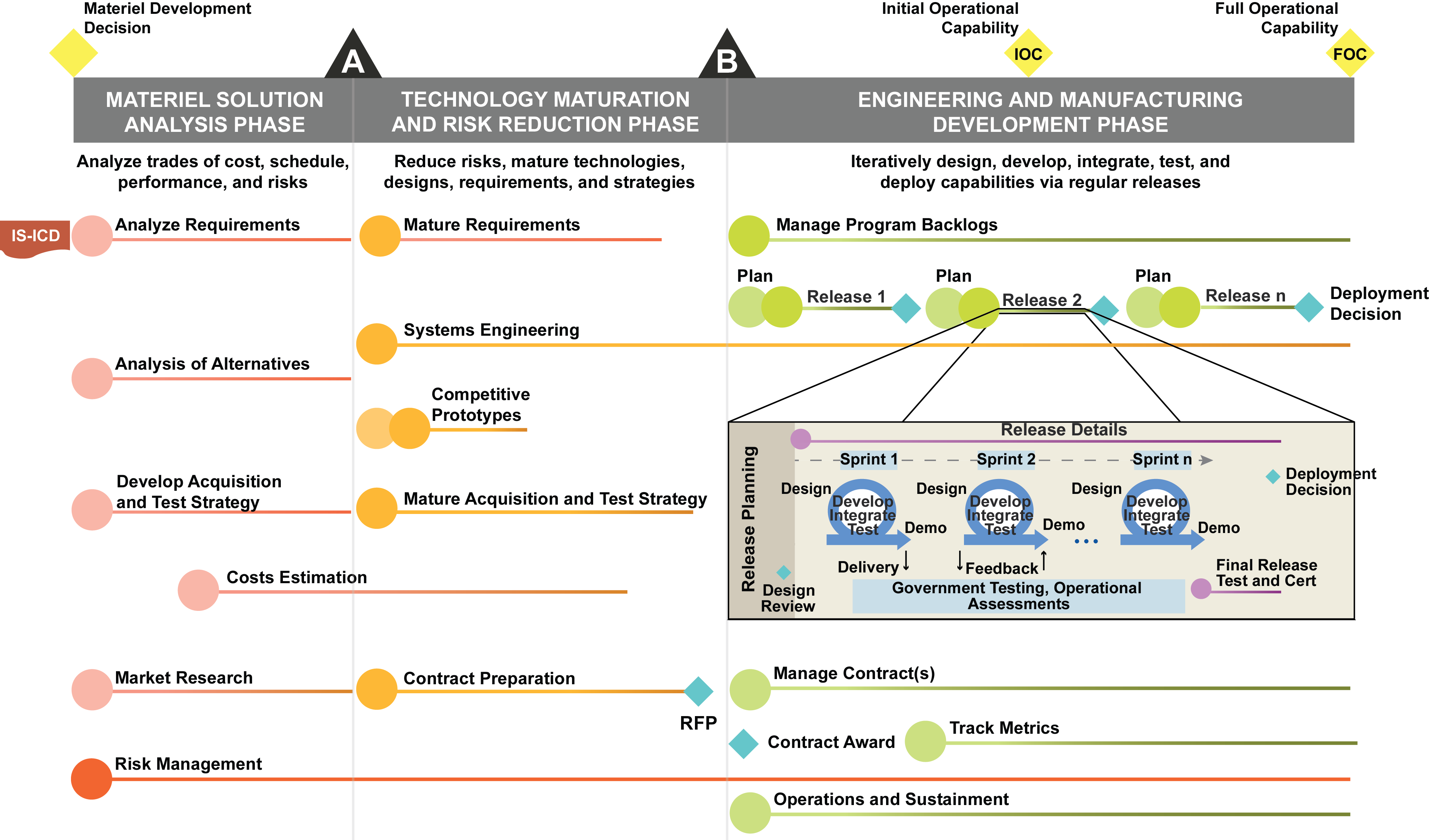

Materiel Solutions Analysis (MSA) Phase

Agile Fundamentals Overview

Agile Glossary

MATERIEL SOLUTION ANALYSIS (MSA) PHASE

Materiel Development Decision (MDD)

Analyze Requirements

Analysis of Alternatives (AoA)

Develop Acquisition Strategy

Market Research

Cost Estimation

Risk Management

TECHNOLOGY MATURITY AND RISK REDUCTION (TMRR) PHASE

Milestone A

Mature Requirements

Competitive Prototyping

Systems Engineering

Mature Acquisition Strategy

Contract Preparation

Risk Management

Request for Proposal

ENGINEERING & MANUFACTURING DEVELOPMENT (EMD) PHASE

Milestone B

Manage Program Backlogs

Release Execution

Manage Contracts

Metrics

Scaling Agile

Market Research

Active engagement with industry is critical to program success. Programs must conduct market research as a continuous lifecycle activity versus a single one-time contracting activity. In the Agile environment, market research should focus on identifying Agile development contractors in the market, existing contract vehicles that accommodate Agile development, and the potential capability for small businesses to provide this type of support. Agile development can potentially be available through non-commercial contractors such as research institutions, government integration labs, and in-house software development services. Because in most cases Agile produces incremental releases developed by small teams, this approach often provides a prime opportunity to utilize small business contractors.

In a general sense, programs must conduct market research before developing the needs for the procurement and before soliciting bids or proposals for a contract in excess of the simplified acquisition threshold. As part of such an integrated market research effort, the government should also communicate early and often with the commercial sector.

The acquisition team is usually comprised of representatives from all disciplines (e.g., program management, engineering, technical, contracting, logistics, budget and small business) and established early in the process. Information gathered during market research should be used to refine the requirements to maximize the benefit of competitive market forces. To provide input to the team constructing the acquisition strategy/plan, contracting personnel gather information on customary contract terms and conditions, representative incentive provisions, and pricing practices.

Some market research techniques include:

- Releasing a Request for Information (RFI) to solicit industry input on requirements, potential acquisition strategies, and gauge current industry interest and market capabilities

- Contacting knowledgeable individuals in government and industry regarding market capabilities

- Reviewing results of recent market research reports covering similar items

- Querying internet information sources (vendor/industry sites)

- Gathering market information on specific products and potential suppliers

- Gathering market pricing and technical information from commercial or government sources

- Gathering market information on industry practices, supply and demand trends, and other relevant factors

- Obtaining source lists from other agencies and professional associations

- Reviewing industry catalogs and product literature

- Conducting interchange meetings or holding pre-solicitation conferences and other government-industry interchanges

- Visiting contractors; attending industry and trade shows

- Gathering information from market or trade journals and magazines

The acquisition team conducts in-depth market research to address the business and technical considerations of the requirements. This includes identifying existing contracts (internal and external to the agency) via the Government wide database of contracts (Interagency Contract Directory). . The database includes Government-Wide Acquisition Contracts, Multi-Agency Contracts, Indefinite Delivery Contracts, Federal Supply Schedules, Basic Ordering Agreements, and Blanket Purchase Agreements. The team also engages with industry for additional market research. Additional information on market research can be found on the DAU Services Acquisition Mall.

Once the acquisition team receives the results of the market research, the team analyzes and documents the findings and recommendations in an evolving acquisition strategy document and market research report. Market research should continue throughout the acquisition process and build on findings, not only because it is required by statute, but also, more importantly, because it gathers the data needed for making good acquisition decisions.

Market Research for Agile Development

When conducting market research for Agile suppliers, the team should investigate a few key aspects to determine supplier capability and market conditions; for example:

- Are there suppliers in the current marketplace that have demonstrated experience with Agile?

- What type of Agile experience does a given firm have (government, commercial, or both)?

- What is the market for large versus small businesses in the required field?

Next, the program should investigate if any existing contract vehicles are suitable for Agile development, or if a new type of contract is needed.

- The use of portfolio-level or PEO-level contract vehicles for Agile development is very helpful if a series of programs or projects plan to utilize or consider Agile development.

- If creating a new contract, programs should explore the option of making the contract available for others in the same agency/department to utilize to facilitate and streamline the contracting process for others interested in pursuing Agile development.

Issuing an RFI is a common market research technique that allows the government to gather market data from industry and request input on a potential acquisition strategy. In the case of Agile development, the RFI can ask vendors to identify the software development process that they currently use, provide examples of other government or commercial programs/projects where they have used Agile development methods, and request industry input on the Agile development strategy the government intends to use. The government can continue to refine its Agile development approach based on the responses received from industry, and gauge the market interest and capabilities for the software development being pursued.

Combining the market research under an RFI with an Industry Day that involves a networking session with potential primes, subcontractors, and non-traditional companies potentially interested in entering the federal marketplace produces greater benefits. An Industry Day can also take the form of an interactive session where vendors can provide live-demonstrations and conduct one-on-one sessions with the government to showcase their products developed using an Agile methodology.

The RFI can include a draft copy of the Performance Work Statement, proposal instructions, evaluation criteria, pricing methodology, terms and conditions, etc. Furthermore, the government can ask industry for input on the design of the Agile contract. Sample questions to include in an RFI are:

- What additional information does your company need to decide to submit a proposal in response to this RFP?

- Is your company already on any existing contract that can be leveraged for this effort?

- What contract type should the Government use for this program?

- What pricing methodology do you recommend for this contract?

- What percentage of your company’s Agile development supports clients developing Agile projects on their own rather than large-scale outsourcing projects?

- What was your revenue associated with Agile-type development last year?

- Has your company worked on similar government-related Agile efforts? If so, can you provide the contract information?

- Will your company require partnerships with other commercial entities in order to deliver the scope of this effort? If so, what areas of the contract scope do you envision supporting versus subcontracting with another firm?

References

- DoD Market Research Guide for Acquisition of Services, Apr 2012

- Market Research Outcomes and Video, DAU’s Service Acquisition Mall

- FAR Part 10, Market Research

- Market Research Briefing, Larry Floyd, DAU, Apr 2012

- Market Research, SD_5, DoD Standardization Program, Jan 2008

0 Comments